child tax portal still says pending

The amount increased from a maximum of 2000 per child to. My child tax credit monthly refund says that my eligibility is pending.

Why Is My Eligibility Pending For Child Tax Credit Payments

July 27 2021 459 AM.

. The IRS is providing eligible families with payments ranging from 250 to 300 per month. It says pending in my portal and Im not sure why because I got the letter. I dunno whats going on.

If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you qualify. 2021 Tax Filing Information Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. I think its because I filed an amended return in 2020 but my tax return status says that Im good to go.

Do not use the Child Tax Credit Update Portal for tax filing information. If on the IRS website in Eligibility Status of your Child Tax Credit it says Pending your eligibility has not been determined. Someone please explain to me why my ctc status still says pending eligibility you will not receive payments at this time.

The child tax credit update portal allows users to make sure they are registered to receive advance payments. If the portal says a payment is pending it means the irs is still reviewing your account to. The child tax credit was changed significantly in 2021 making it fully available for the first time to the lowest-income families including those who typically do not have to file a tax return.

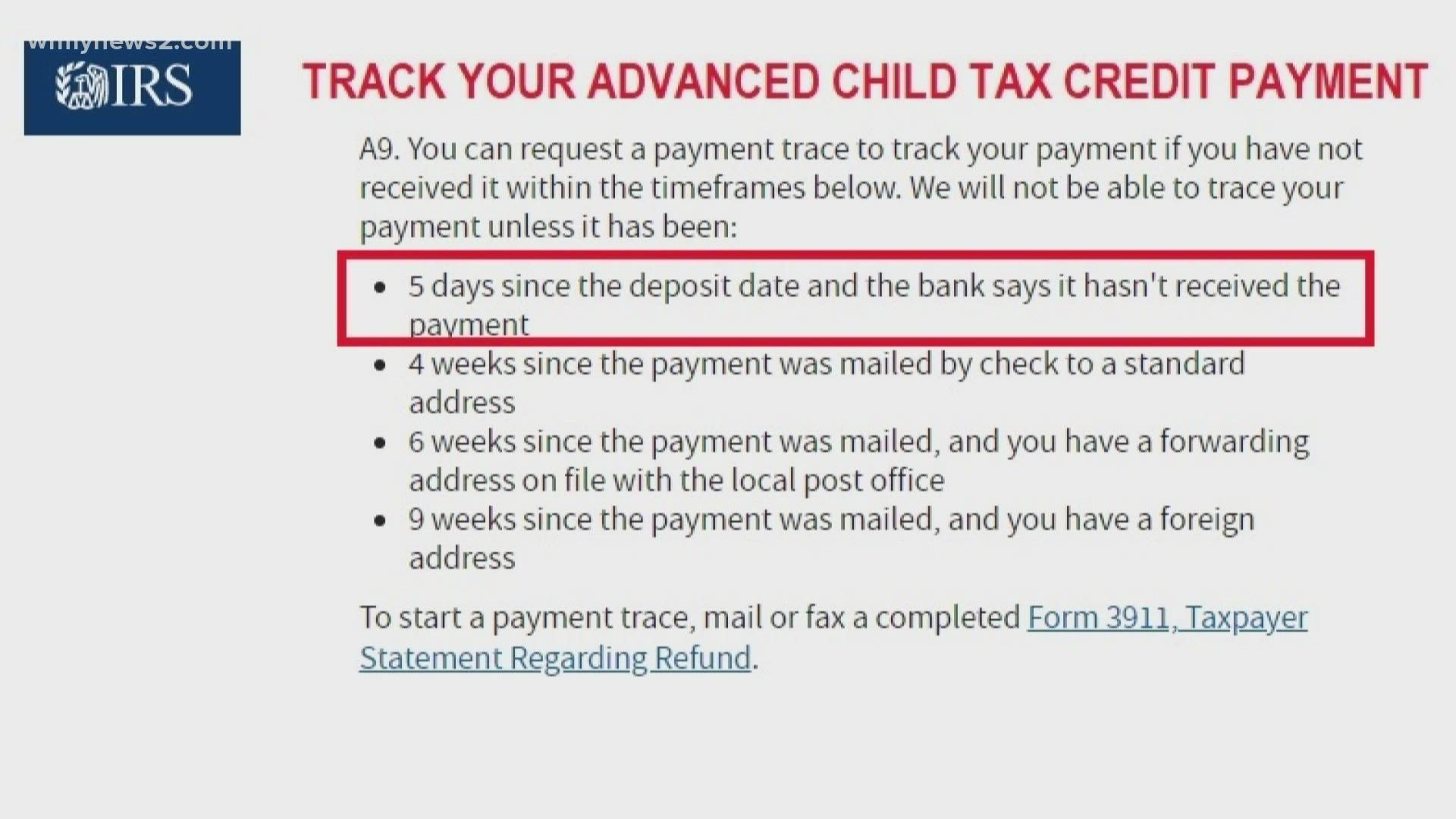

The Child Tax Credit Update Portal is no longer available. At first glance the steps to request a payment trace can look daunting. 4 weeks since the payment was mailed by check to a.

If the child tax credit update portal returns a pending eligibility status it means the irs is still trying to determine whether you qualify. A community to discuss the upcoming Advanced Child tax credit. Why does my child tax credit say pending opt out of child tax creditWatch Our Other VideosIRS unemployment tax refund.

If your eligibility status is pending it means that the irs is still determining whether you qualify. Im listed as pending. Portal still says pending eligibility I received July and August just fine but early September the portal changed to pending eligibility.

For your future september paymentor youre still waiting for a payment from july or augustyou can use the child tax credit portal to check if. Or at least go by 2019 as the portal says they would. Im just hoping the site hasnt updated yet.

In the beginning of the phone call and say they cant access your tax return. For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. There was no reason for it to change in the 1st place.

My 2020 return was processed but then went under review. So i dont know if thats considered not processed or not but regardless they should be able to see my dependents on there regardless. 2 days agoPeople can also get any pandemic stimulus payments they are still owed through the portal.

Why is my advanced child tax credit pending eligibility. My status on. I am a single mom with 2 children and have been asking for help with this situation since sept 2nd.

I had to amend my return to get the 10200 unemployment tax credit for 2020 and to get some. My 2019 taxes were filed on time so if its going off that tax year there should be no delay. To be eligible for the full amount a taxpayer must have modified adjusted gross income of 75000 or less for single filers 150000 or.

According to the IRS if your return even an amended one is still processing then you will not receive the advance child tax credit payments. I got all other stimmies fine. If the Child Tax Credit Update Portal returns a pending eligibility status it means the IRS is still trying to determine whether you 1.

If the child tax credit update portal returns a pending eligibility status it means the irs is still trying to determine whether you qualify. Parents of children under age 6 would be eligible for an even larger 3600 total credit. Child tax credit update portal.

5 days since the deposit date and the bank says it hasnt received the payment. Check the Child Tax Credit Update Portal Check the IRS Child Tax Credit Update Portal to find the status of your payments whether they are pending or processed. IRS says portal now open to update banking info for Child Tax Credit payments.

I have received every stimulus check do NOT have an amended return and fit all eligibility requirements yet Im still pending eligibility. I am eligible to receive the advance child tax credit but didnt get the first payment. I STILL have not gotten a payment for September and it looks like my portal STILL says pending eligibility.

10200 unemployment tax break IRS p. I talked for 40 minutes to Commissioner Rettig on June 18 Sen. Why does my child tax credit say pending opt out of child tax creditWatch Our Other VideosIRS unemployment tax refund.

Now the portal still says pending but shows that we got 000 mailed or deposited on Sept 15 under the processed payments which we never had any info down there prior. This is so frustrating. I think its because I filed an amended return in 2020 but my tax return status says that Im good to go.

A community to discuss the upcoming Advanced Child tax. Those with children under the age of 6 will receive 300 per month while those with children from 6 to 17. Low-income parents now have another chance to get the enhanced 2021 child tax credit without filing a full tax return.

Recipients can check the status of the monthly payment at the irs child tax credit update portal. My status on IRS portal says my CTC is pending. One is 2 and the other is 9.

I have already received my 2020 taxes months ago. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

Why Is My Eligibility Pending For Child Tax Credit Payments

Going From Eligible To Pending Eligibility For Advanced Ctc Payments What The Irs Told A Client Youtube

Why Is My Eligibility Pending For Child Tax Credit Payments

Child Tax Credit 2021 Irs Chief Warns Payments May Be Delayed Abc7 San Francisco

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Where S My Child Tax Credit Payment A Guide For Frustrated Parents The Washington Post

Child Tax Credit Payment Delays Frustrating Families In Need The Washington Post

Where Is My September Child Tax Credit 13newsnow Com

9 Reasons You Didn T Receive The Child Tax Credit Payment Money

Missing A Child Tax Credit Payment Here S How To Track It Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Here S Why Your Payment Is Lower Than You Expected The Washington Post

Child Tax Credit 2021 How To Track September Next Payment Marca

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credits September Payments Go Out Soon What To Do If You Don T Get One

What A Pending Status May Mean On Your Child Tax Credit Portal From An Irs Phone Call Experience Youtube

Missing A Child Tax Credit Payment Here S How To Track It Cnet